About us

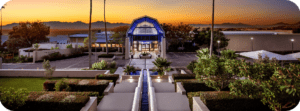

Unapologetically Real Experiences

Tsogo Sun Limited (Tsogo Sun) is the largest Casino, Hotel and Entertainment company in South Africa. The Group is listed on the Johannesburg Stock Exchange (JSE) and has a market capitalisation of approximately R14bn. It is ranked among the 80 largest companies listed on the JSE.

Hosken Consolidated Investments Limited (HCI), a JSE-listed investment holding company, directly and indirectly owns 49.5% of the Tsogo Sun shares.

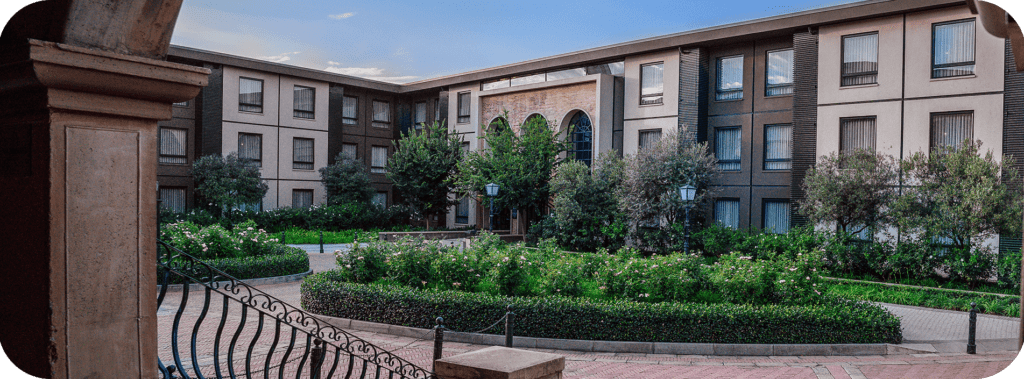

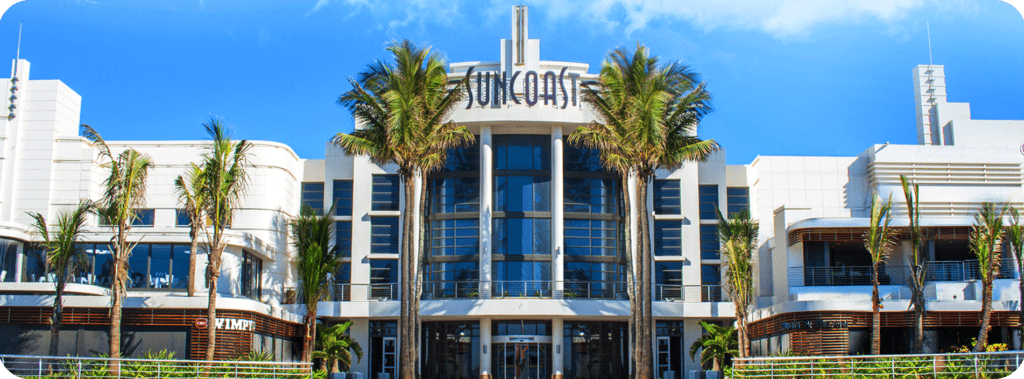

Tsogo Sun owns and operates 14 premier casino and entertainment destinations and 19 Hotels throughout South Africa.

All of Tsogo Sun’s complexes incorporate ancillary offerings, including accommodation in more than 1 700 rooms, conferencing facilities, a theme park, theatres (with the Teatro at Montecasino being the largest), cinemas (under the house brand movies@), restaurants and event spaces.

Tsogo Sun’s landbased operations are complemented by online offerings trading under playTsogo.co.za and bet.co.za. The online businesses include betting on sports and casino-styled games.

The Group is also active as VSlots in the Limited Payout Machine (LPM) market, providing slots with a limited bet and limited payout. In addition, Electronic Bingo Terminals (EBT’s) offer Bingo under the Galaxy Bingo brand, located at 23 sites across South Africa.